Permanent Life Insurance Products

Below is a comparative analysis of permanent Life Insurance products.

All will ensure that your income is protected in case something happens to you.

All of them provide life insurance protection for 121 years.

There are a few different options you can choose from.

You can even decide to choose a combination of products to fit your unique needs.

Take a look at how these options stack up

Guaranteed lifetime protection and access to cash value that's guaranteed to grow.

Lifetime protection as long as your premiums are paid.

Premiums are guaranteed to never increase, and there are options for how long and how often you pay—monthly, quarterly, or yearly.

Guaranteed cash value growth that can be accessed when needed and may increase through dividends, when paid. These benefits accrue tax deferred, allowing you to maximize your savings.

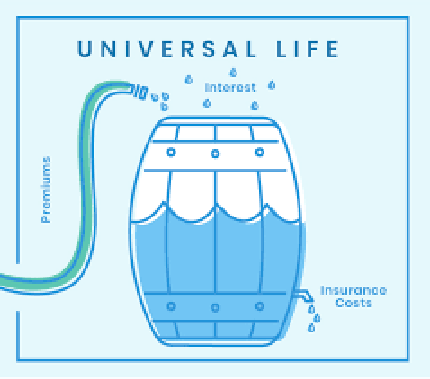

Flexible life insurance policy that comes with a cash value. You can (increase or decrease) how much you pay towards premiums, the difference is withdrawn from your policy’s cash value.

Lifetime protection as long as your premiums are paid.

This is a flexible premium policy, you have the option to maintain your initial premium or adjust it based upon your budget or coverage needs.

You determine how often you pay: monthly, quarterly, semiannually or annually

Guaranteed cash value growth that can be accessed when needed and may increase through dividends, when paid. These benefits accrue tax deferred, allowing you to maximize your savings.