COMPARE

You may be considering the best way to solution for your family’s future. Ensuring that your income is protected in case something happens to you is a good place to start. Life insurance can help with that, and there are a few different options you can choose from. You can even decide to choose a combination of products to fit your unique needs. Take a look at how these options stack up below.

The Basics

Temporary coverage, often with options that allow you to prepare for the future.

Guaranteed lifetime protection and access to cash value that's guaranteed to grow.

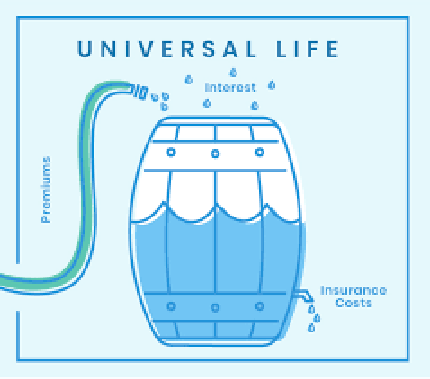

Flexible life insurance policy that comes with a cash value. You can decrease (or increase) how much you pay towards premiums. If you decrease how much you spend on premiums, the difference is withdrawn from your policy’s cash value.

Flexible premium life insurance policy where you are able to increase or decrease your premium payment. The lowest amount of the premium can only be to the cost of insurance.

What differentiates the Index Universal Life Policy from the Universal Life policy is it offers the option of having cash value accumulate at interest based on the changes of a major market index and your money is never in the Market; therefore you never lose any money.

Length of coverage

Temporary coverage, often with options that allow you to prepare for the future.

Lifetime protection as long as your premiums are paid.

Lifetime protection as long as your premiums are paid.

Lifetime protection as long as your premiums are paid

How you pay

A set period of time, usually 10 to 20 years.

Premiums are guaranteed to never increase and there area options for how long and how often you pay: monthly, quarterly, semiannually or yearly

This is a flexible premium policy, you have the option to maintain your initial premium or adjust it based upon your budget or coverage needs.

You determine how often you pay: monthly, quarterly, semiannually or annually

This is a flexible premium policy, you have the option to maintain your initial premium or adjust it based upon your budget or coverage needs.

You determine how often you pay: monthly, quarterly, semiannually or annually

Cash value and growth

None

Guaranteed cash value growth that can be accessed when needed and may increase through dividends, when paid. These benefits accrue tax deferred, allowing you to maximize your savings.

Guaranteed cash value growth that can be accessed when needed. Cash value earns interest at a variable rate set by the life insurance company.

Cash Value is set to a minimum guaranteed interest rate, but your actual rate varies based on the performance of a chosen investment fund and could outperform other cash value policies.

Life insurance benefits

The beneficiary receives a guaranteed death benefit which is typically income-tax free.

The beneficiary receives a guaranteed death benefit which is typically income-tax free.

The beneficiary receives a guaranteed death benefit which is typically income-tax free.

The beneficiary receives a guaranteed death benefit which is typically income-tax free.

Term Life Insurance

Whole Life Insurance

Universal Life Insurance

Index Universal Life Insurance

Configure a solution that aligns with your needs

Now that you’ve seen some options and understand how various products work, you can build a strategy that’s personalized for your family’s needs. It can be helpful to speak with a financial professional about different ways to combine features. Our expert guidance can help you make decisions on insurance types and the available add-ons.